JP MORTGAGES

Residential Loans

At JP Mortgages, we specialize in providing residential loans that cater to the unique needs of every homeowner. Whether you’re a first-time homebuyer looking to step into the property market or an existing homeowner planning to upgrade or refinance, our team of experienced mortgage brokers is here to guide you through the process.

We offer a variety of mortgage products, including fixed-rate, variable-rate, and interest-only loans, each designed to provide you with the flexibility and financial stability you need. Our goal is to make homeownership accessible and affordable, ensuring that you can find a loan that fits your budget and long-term financial plans.

Navigating the world of residential loans can be complex, but it doesn’t have to be. Our dedicated team is committed to simplifying the mortgage process, providing clear, expert advice every step of the way. From pre-approval to approval, we handle all the details, ensuring a seamless and stress-free experience.

We work with a broad network of lenders to offer competitive rates and tailored loan options, helping you secure the best possible terms for your mortgage. Trust us to be your partner in homeownership, delivering personalised solutions that align with your goals and providing ongoing support as your needs evolve.

JP MORTGAGES. THE RIGHT PEOPLE, THE RIGHT CHOICE.

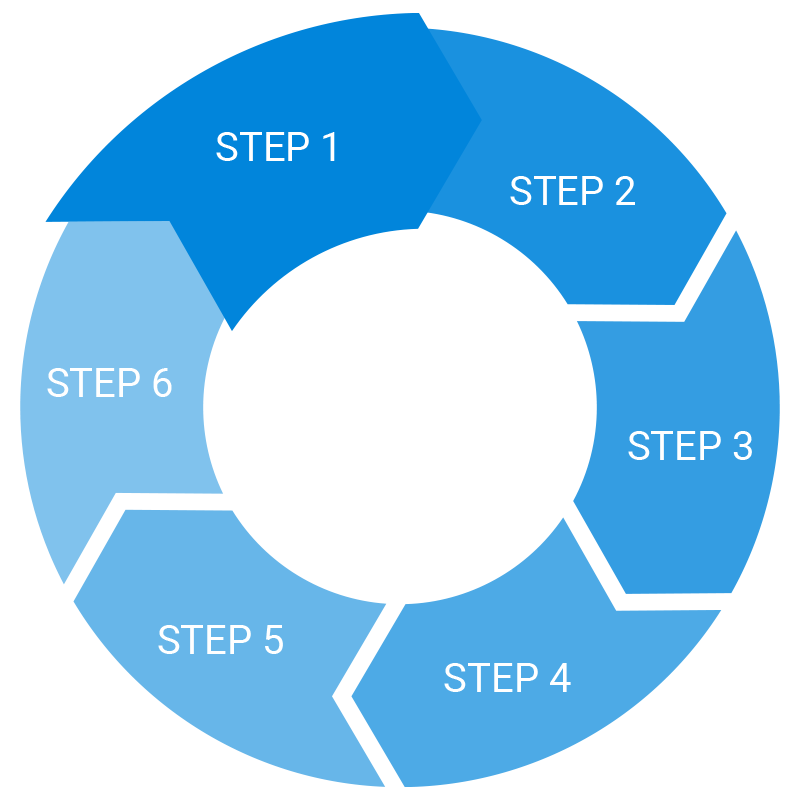

Our Process

Step 1

Contact Our Team

Reach out to our team to discuss your goals and how we can support you in achieving them, whether this may be seeing if there is a better deal out there than your current mortgage or releasing some equity to finish that renovation or consolidating some personal loans and credit card debt.

Step 2

Appointment

Your Broker will help walk you through the process and present you with a selection of loan options that are tailored to fit your specific needs and circumstances.

Step 3

Preparing Your Application

Once you are happy with our recommendation that best fits your financial needs and goals, we will proceed to prepare your loan application. We will guide you through each step of the process, ensuring that your application is thorough and optimized for approval.

Step 4

Submitting Your Application

Once your loan application is submitted, we will collaborate with the lender to expedite the approval process. We will address any queries promptly and keep you informed throughout, aiming to secure a fast and favourable outcome. Our goal is to expedite the approval process while keeping you informed every step of the way.

Step 5

Settlement

Once your loan is approved, we will work closely with all relevant parties to ensure settlement occurs in a timely manner.

Step 6

Ongoing Support

Additionally, our support doesn’t stop after settlement. We’re committed to saving you as much money as possible with regular loan reviews! Relax and have peace of mind knowing we’ve got your back.

Meet Our Lenders

We are proud to offer to you a carefully curated network of reputable lenders who share our commitment to excellence and client satisfaction. Our extensive partnerships encompass a diverse array of financial institutions, including major banks, credit unions, and private lenders, ensuring that we can offer our clients a comprehensive range of loan options tailored to their unique needs.

Our Success Clients

I can’t express highly enough how professional and helpful the team were at JP Mortgages. With their experience and knowledgeable advice we were able to purchase our beautiful home.

Definitely recommend to anyone, thanks so much JP Mortgages.

I can’t express highly enough how professional and helpful the team were at JP Mortgages. With their experience and knowledgeable advice we were able to purchase our beautiful home.

Definitely recommend to anyone, thanks so much JP Mortgages.

Natasha Stone

Can’t recommend james and the rest of the team at JP mortgages enough! Easy to contact and communicate with from the get go. Went above and beyond to put me at ease! The ongoing support is second to none and I’ll definitely be back. Can’t thank James enough for all his work

Can’t recommend james and the rest of the team at JP mortgages enough! Easy to contact and communicate with from the get go. Went above and beyond to put me at ease! The ongoing support is second to none and I’ll definitely be back. Can’t thank James enough for all his work

Sam Hunt

James, Matt and Alyssa have been very helpful and professional from the very start when I first let them know my situation right up until the very end when my mortgage was settled. I recommend for all property investors in Aldinga and surrounding region to count on JP Mortgages for their loan solutions. I will be using their services again soon when it comes to investing in my next property, probably in a year from now.

James, Matt and Alyssa have been very helpful and professional from the very start when I first let them know my situation right up until the very end when my mortgage was settled. I recommend for all property investors in Aldinga and surrounding region to count on JP Mortgages for their loan solutions. I will be using their services again soon when it comes to investing in my next property, probably in a year from now.

Stavros Markou

If you questioning whether a Mortgage Broker is the way to go? Then trust me when I say, making the step to go see JP mortgages will put you at ease. I was so unsure where to start with buying my first home. As soon as I arrived to see James and Alyssa, they made me feel so comfortable. They’ve made sure every step was informative and seamless. Now thanks to the team I’m a first time home owner. Will definitely be back

If you questioning whether a Mortgage Broker is the way to go? Then trust me when I say, making the step to go see JP mortgages will put you at ease. I was so unsure where to start with buying my first home. As soon as I arrived to see James and Alyssa, they made me feel so comfortable. They’ve made sure every step was informative and seamless. Now thanks to the team I’m a first time home owner. Will definitely be back

Michelle Binns

James & the team did an incredible job at getting my house loans documents ready in such a short amount of time. I couldn’t be more grateful! Highly recommended for their great communication, expertise & friendliness.

James & the team did an incredible job at getting my house loans documents ready in such a short amount of time. I couldn’t be more grateful! Highly recommended for their great communication, expertise & friendliness.

Amy-Lee Macrow

After waiting in the banks for months we decided to make an appointment with James. Best decision ever he explained everything and the turn around was quick - would definitely recommend!

After waiting in the banks for months we decided to make an appointment with James. Best decision ever he explained everything and the turn around was quick - would definitely recommend!

Nikki Jones

If I could give more stars I would. JP Mortgages gives incredibly professional service.

If I could give more stars I would. JP Mortgages gives incredibly professional service.

Kirsty Martinese

frequently asked questions

By using a broker, you are essentially walking into 35 different banks at the same time. We will work out your individual needs and requirements and make a recommendation that is in your best interests.

With over 35 lenders we can make sure you are getting matched with the right lender for you, whatever your situation or current stage of life.

Each individual lender has its own timeframe that they are working towards, and your broker will let you know how long your application is expected to take. We can get an approval with some lenders in as little as 1 day.

We do not charge a fee for our services. We receive a commission payment from the lender for arranging loans between customers and finance companies.

Areas We Service

- Aldinga

- Aldinga Beach

- Sellicks Beach

- Myponga

- Mount Compass

- Seaford

- Moana

- Willunga

- Christies Beach

- Hallett Cove

- Port Willunga

- Sellicks Hill

- McLaren Vale

- Seaford Rise

- Seaford Heights

- Seaford Meadows

- Port Noarlunga

- Port Noarlunga South

- Old Noarlunga

- Maslin Beach

- Morphett Vale

- Woodcroft

- Hackham

- Hackham West

- Aldinga

- Aldinga Beach

- Sellicks Beach

- Myponga

- Mount Compass

- Seaford

- Moana

- Willunga

- Port Noarlunga

- Port Noarlunga South

- Old Noarlunga

- Maslin Beach

- Christies Beach

- Hallett Cove

- Port Willunga

- Sellicks Hill

- McLaren Vale

- Seaford Rise

- Seaford Heights

- Seaford Meadows

- Morphett Vale

- Woodcroft

- Hackham

- Hackham West